Minerva Risk Advisors

Description of Minerva Risk Advisors

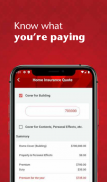

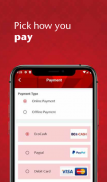

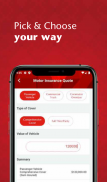

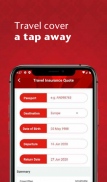

All in One Insurance Broking mobile application designed to provide our B2C with a platform to

- Sign up

- Buy insurance

- Pay for Insurance

- Enquire about existing insurance

- Report Claim

- Receive Claim Status Updates

Founded in 1947, Minerva has a long history of providing innovative and effective risk and people solutions, through industry-leading resources, and technical expertise.

Minerva delivers distinctive client value through a strong culture of innovation, teamwork and integrity.

As the Exclusive Aon Correspondent Office for Zimbabwe, Minerva has access to more than 65,000 insurance professionals worldwide, in over 120 countries. Aon has been named repeatedly as the world's best broker, best insurance intermediary, reinsurance intermediary, captives manager and best employee benefits consulting firm by multiple industry sources.

Minerva Risk Solutions – is the largest division of Minerva in number and revenue. The global link with Aon Risk Solutions allows Minerva Risk Solutions to tap into a huge pool of unmatched talent and unsurpassed resources in the insurance industry to bring relevant solutions to any client in Zimbabwe.

Minerva Risk Management Services – operates in consultation with Aon Risk Management Services worldwide thus bringing world class risk management services and solutions to their local clients. Insurance and risk management services are the cornerstone of every company’s capital structure. Poorly constructed programmes leave companies vulnerable to major long-term set backs and possibly insolvency. Effective risk management is invaluable to clients who strive to maintain world-class certification and compliance such as ISO.

Benefits Consulting –Minerva is a pioneer and market leader in the provision of employee benefits services to pension funds. We offer a broad range of services including administration, programme design, advice on legislation compliance, monitoring the performance of asset managers.

Reinsurance – Minerva Re designs and advises on structuring optimal reinsurance programs for underwriters. Major products include: treaty broking (all classes), facultative broking (all classes), alternative risk transfer, claims recoveries. reinsurance accounting, and market intelligence.